Auction Terminology

This information is intended as a guide only, if you're considering purchasing a property at auction you should always consult with auction professionals.

Glossary

Absentee Bid

This allows those who cannot or do not wish to attend an auction to bid. Absentee bids are also called “written,” “commission” or “proxy” bids.

Abstract of Title

A schedule listing the documents which set out the history of ownership of a property.

Actual completion date

The date when completion takes place or is treated as taking place for the purposes of apportionment and calculating interest. Addendum An amendment or addition to the conditions or to the particulars or to both whether contained in a supplement to the catalogue, a written notice from the auctioneers or an oral announcement at the auction.

Addendum

An amendment or addition to the original conditions. This may be a written notice in the catalogue or announced at the auction.

Adopted Highway

A road maintained by a local authority.

Advance

The initial amount provided by your lender to assist with the purchase. The advance received is less than the amount you have actually agreed to borrow due to your lender deducting their fees and charges.

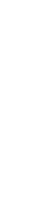

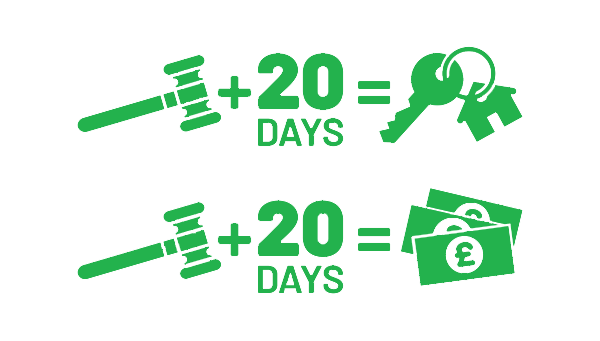

Agreed completion date

Either the date specified in the special conditions

or

if no date is specified, 20 business days after the contract date; but if that date is not a business day the first subsequent business day.

Approved financial institution

Any bank or building society that has signed up to the Banking Code or Business Banking Code or is otherwise acceptable to the auctioneers.

Arrears

Arrears of rent and other sums due under the tenancies and still outstanding on the actual completion date.

Arrears schedule

If any, the arrears schedule will form part of the special conditions.

Assent

A formal document required to transfer ownership of property to a person entitled to it following the death of the owner.

AST or Assured Shorthold Tenancy

The default and most common form of tenancy agreement for residential properties in England. If you are currently renting a property under an AST you will need to contact your landlord about bringing the tenancy to an end when your purchase completes. Alternatively, if you are buying a property to rent out you will most probably be entering into one of these with a tenant soon after completion!

Attorney

Someone appointed formally to act on behalf of another, either generally or for a specific purpose.

Auction

The auction advertised in the catalogue. The auction commences when the auctioneer looks for bids on a given Lot. Once the first bid is made, others may offer higher bids. Bidders may be present in the saleroom, on the phone or online. The Auction House staff may also place bids on behalf of absentee bidders. That Lot finishes when, if someone has been successful, the auctioneer strikes the gavel down and announces, “sold”. If the Lot does not meet its reserve or there are no bidders, the auctioneer will signify this with a “pass.” See Understanding Auctions.

Auction conduct conditions

The conditions so headed, including any extra auction conduct conditions.

Auctioneer

The trained professional who presides over the auction, initiating the sale of a lot by describing the item and starting the bidding.

Bankruptcy Search

Prior to exchange of contracts, an appropriate search is made against the names of the buyer by the buyer’s solicitors to ensure that there are no current bankruptcy proceedings against them to protect the mortgage lender.

Bankers Draft

A cheque drawn by a bank, which is generally accepted as the equivalent as cash although it needs to be paid into the bank's clearing system in the same way as any other cheque.

Bid

The amount offered by prospective buyer(s), signalled to the auctioneer that he/she would pay to buy the lot during bidding. If bidding, make sure the auctioneer has seen and registered your bid.

Bid Increment

The amount by which the auctioneer increases the bidding. This may range from hundreds to tens of thousands of pounds. The figure is generally rounded up or down at the auctioneer's discretion.

Boundaries

Boundaries define the limits of the property and are usually marked with fencing, hedging or walls. They are generally shown explicitly on the Deeds Plan and are often marked with inward or outward ‘T’ markings indicating whether the property in question or the neighbouring property own the boundary fences

Breach of Contract

Following contract exchange (fall of the gavel at auctions), if either party pulls out and does not complete the conveyancing process, they are in breach of contract and the non-defaulting party can seek legal redress for any losses.

Bridging Loan

This is a short term loan to help fund your purchase. See Bridging Finance.

Brine search

A search carried out to establish if a property is affected by disused workings near the property.

Building insurance

Once contracts have been exchanged, the buyer will in most cases become responsible for the new property’s building insurance from the date of exchange (not the date of completion). This must cover the cost of rebuilding the entire property if it is destroyed. Your mortgage lender may want to see proof of this insurance. See Auction Insurance

Building regulation approval

Approval by the local authority on the design and construction. See Building Regulations.

Business day

Any day except a Saturday or a Sunday; a bank holiday in England and Wales; or Good Friday or Christmas Day.

Building Regulations

The standards concerning the design and construction of buildings, covering the health and safety of the people using the building, energy conservation and access. Evidence of compliance with the regulations will be required for any building work carried out at the property, from extensions and loft conversions to replacement windows or a new boiler.

Buyer

The person or persons who agree to buy the lot or, if applicable, that person’s personal representatives. If two or more are buying together their obligations can be enforced against them jointly or against each of them separately.

Buyer's Administration Fee

A payment made by the Buyer to the Auctioneer at the point of exchange to cover the administration costs that the auction incurs.

Catalogue

The catalogue contains the basic details of the Lots and the general Conditions of Sale. The catalogue description forms part of the Contract.

Caveat Emptor

This literally translates to ‘let the buyer beware’ and means the buyer is responsible for finding out the condition of a property.

Chain

Where a seller is buying another property this leads to a series of linked sales and purchases, which ends with a property that has no onward chain, for instance a home sold by someone moving into a retirement home or a home being sold by the estate of someone who has died. Everybody in the chain has to agree on completion dates; if the completion date is delayed by one party in the chain, the whole chain is delayed.

CHAPS

Clearing House Automated Payment System - the system allows for the payment of any amount to be transmitted electronically by one bank or branch to another on the same day. On the day of completion the balance of the purchase price is paid by a transfer of funds between solicitors’ client accounts by electronic transfer.

Chattels

Items left at a property that are included in the purchase price, such as furniture. These are described on the Fixtures, Fittings and Contents form.

Cleared Funds

The amount of money in an account that is available for withdrawal or transfer. This can include a cleared cheque, banker’s draft, cash, CHAPS, telegraphic transfer or BACS payment.

Coal mining search

If the property is situated in a coal mining area this search will be conducted by the property lawyer to find out if coal mining activities will affect the property in the future.

Commons Registration Search

A search carried out by local authorities to ensure a property is not registered as common land or connected to a village green, resulting in third party rights over the property.

Completion

The date by which the sale must be finalised, when ownership of the property passes from the seller to the buyer. The balance of the price is unconditionally received in the seller’s conveyancer’s client account. Penalties will be applied if the sale is completed late which can include losing your deposit.

Condition

The contractual Conditions under which the Lot is sold, including General Sales conditions and possibly Special Conditions. The General Conditions apply to the contract except to the extent that they are varied by Special conditions or by an addendum.

Completion date

This is the date that ownership of the property passes from the seller to the buyer. Only when contracts are exchanged and a completion date is fixed can you be virtually guaranteed that the completion date will be met.

Completion statement

A documented financial breakdown of all the receipts and payments due in respect of the transaction normally sent after exchange but before completion, this includes legal fees, disbursements and VAT.

Commons Registration Search

A search at the local authority to check the property is not registered as common land or part of a village green resulting in third party rights over the property, e.g. grazing, resulting in the enjoyment of the property being limited.

Contaminated Land

Land affected by contamination that might arise from its former use or by things stored there in the past, e.g. petrol station.

Contract

The legal agreement by which the seller agrees to sell and the buyer agrees to buy the lot, which sets out all the legal terms, rights and obligations agreed between them.

Contract date

The date of the auction or, if the lot is not sold at the auction:

(a) the date of the sale memorandum signed by both the seller and buyer; or

(b) if contracts are exchanged, the date of exchange. If exchange is not effected in person or by an irrevocable agreement to exchange made by telephone, fax or email the date of exchange is the date on which both parts have been signed and posted or otherwise placed beyond normal retrieval.

Conservation area

If the property to be bought lies in a conservation area protected by a local authority, it may be subject to exterior planning restrictions to preserve the look of the area.

Conveyance

Traditionally, a common name for the legal document that officially confirmed the sale or purchase of a property or piece of land. Nowadays the transfer is conducted using a Transfer deed/document although in some cases a conveyance may be used.

Conveyancer

Those who undertake the conveyancing process. Traditionally they are solicitors or qualified persons. In recent years specialists have appeared who solely offer conveyancing as a dedicated service.

Conveyancing

The legal and administrative process of transferring property title from one party to another. See Conveyancing.

Co Owners

Where two or more people jointly own a property and are legally entitled to it.

Covenants

Legal obligations and restrictions that can be attached to a property, contained in a Deed, which can be ‘positive’ or ‘negative’ in nature respectively.

Council for Licensed Conveyancers (CLC)

This is the governing body that licenses and regulates conveyancers. You should always ensure your conveyancer is a full member. See Conveyancing.

Deed of Covenant

Legal obligations which either require a party to refrain from doing something, e.g. not to use a property for business purposes, or to advise a party to do something, e.g. keep property in good repair.

Deed of Gift

A document transferring the ownership of property from one person to another without any payment being made.

Deed of guarantee

A document used where one person agrees to be responsible for someone else’s debt or mortgage obligations if that person fails to carry out their own obligations.

Deed of postponement or guarantee

Where a mortgagee agrees to their mortgage ranking after another lender’s mortgage.

Deeds

As long as the title to the property is registered, this are the official documents confirming who owns the property. They are usually in the possession of the owner or mortgagees if the property is mortgaged. All information previously detailed in the Deeds is now stored electronically at the Land Registry.

Deposit

This is the sum paid on exchange of contracts to secure the purchase, normally 10% of the purchase price but sometimes subject to a minimum figure. The deposit is a part payment on a guarantee that the Buyer will complete the purchase. If the Buyer unjustifiably refuses to complete, the deposit is forfeited and kept by the Seller less Agents and Solicitors fees. You may also have to pay compensation to the seller if the seller loses out through your failure to complete.

Defect in title

A problem with the legal ownership of the property that suggests that the legal owner may be sued or possibly asked to release their interest in a property.

Disbursements

Transactional fees paid to another body on your behalf., e.g. Land Registry fees. Your conveyancer will need money up-front for these, which is why you may be asked for an initial payment when you instruct your chosen firm.

Documents

Documents of title (including, if title is registered, the entries on the register and the title plan) and other documents listed or referred to in the Special Conditions relating to the lot.

Drainage search

A search that checks whether a property is connected to both fresh and foul water sewers.

Easements

Easements are rights that one person has over another person’s piece of land, for instance the right of way over access over a garden. Easements are usually expressly created by or within a Deed, but can also arise through implication if they are deemed necessary, such as a right of way to enable access.

Environmental search

This search is carried out against a property to check if there are any known environmental issues affecting the it, these include matters such as landfill or waste disposal sites in the area, if the property has been built on an old industrial site and whether there are any risks from contaminated land, toxic emissions, flooding, subsidence etc.

Environmental Report

See Environmental Search

Enquiries

These are the enquiries that a conveyancer will raise on their client’s behalf to ensure the buyer knows what they are buying. There are limitless reasons why the buyer’s conveyancer might need to raise enquiries; there might be issues contained within the title; perhaps an extension was built and the planning permission hasn’t been produced; or the property might be subject to flooding or other environmental issues. You must let your chosen conveyancer know of any enquiries you specifically want raised as early as possible.

Epitome of Title

A chronological index of documents which prove title to the land to be mortgaged or sold. It is accompanied by photocopies of the relevant documents.

Equity

This is the difference between the value of a property and the amount owed to the mortgagee.

Exchange of Contracts

If you are the successful bidder at the auction sale, the sale becomes legally binding on the fall of the hammer. You will be asked to sign and exchange contracts in the auction room. Please note, the auctioneer has the authority to sign the contract on behalf of both Buyer and Seller.

Fixture, Fittings and Contents form

A standard form which is attached to the contract that lists the items at the property which are either included or excluded from the agreed price. This form is completed at an early stage by the seller and sent to the buyer, so that both parties understand what is included in the selling price.

Financial charge

A charge to secure a loan or other financial indebtedness (not including a rentcharge).

Flying freehold

This exists where part of one property extends over or under a neighbouring property so the upper property owner does not own the building or land underneath the ‘flying’ part. Special care needs to be taken in these circumstances to ensure that all necessary rights and obligations are present in the title.

Freehold

With a freehold property the owner has absolute title, meaning the complete and absolute ownership of the land and all buildings built on it. Subject to legal and planning constraints, the freehold owner has the right to do as they like with their home and land.

Freeholder

See Lessor.

Full Title Guarantee

A sale agreement which contains a full title guarantee implies certain covenants, or promises, on the part of the seller. Basically it assures, or promises, that the seller has the right to sell the property in the manner purported, the whole of the property in the registered title is being disposed of (if the property is registered), the seller at their own cost, will do all that it reasonably can to ensure the buyer has good title to the assets; and the disposal is made free from all charges and encumbrances and all other rights exercisable by third parties, other than those which the seller does not and could not reasonably be expected to know about.

Fair Warning

This warning is often announced by the auctioneer before the hammer comes down. The fair warning offers one last chance to increase the bidding; if there are no subsequent bids, the auctioneer’s hammer falls and the sale is completed.

Gavel

The common term for the auctioneer’s hammer used to close the bidding.

General conditions

That element of the Sale’s contractual Conditions, may include any extra general conditions.

Ground rent

The annual rent payable paid by a lessee to a lessor where a property is leasehold, usually in yearly amounts. It is effectively rent that you pay for the use of the land on which the properties lies

Hammer Price

The final, winning bid for a lot at auction. It is the price upon which the auctioneer’s hammer falls, determining the sale price, but does not include the buyer's premium.

HM Land Registry

The Central body that retains records of who owns the land, and under what conditions. This was set up in 1925, to simplify the conveyancing process. Not all land in England and Wales is registered today. This is partly due to the fact that land can only be registered following certain "triggering events". The Land Registry has its own website which provides useful information. See Land Registry.

High loan to value fee

This is sometimes charged by a mortgagee where a borrower borrows more than a certain percentage of the value of a property to insure the mortgagee against loss arising if the property is sold by them due to the borrower’s failure to pay the mortgage.

Homebuyers Report

This is a form of survey which lies between a basic Mortgage Valuation and a Comprehensive Structural / Building Survey both in cost and level of detail. It comes in a standard format and is only intended for conventional properties which are in reasonable condition. This survey will focus on the essentials that you, as a property purchaser, should be aware of and will highlight any significant problems or defects.

Identification

To comply with the Money Laundering Regulations and anti-terrorist legislation, in any transaction involving large sums of money, such as conveyancing, your conveyancer will ask for identification to confirm your identity.

Index Search Map

A search undertaken at the Land Registry to ascertain if a property is registered or unregistered.

Indemnity Contribution

The Indemnity Contribution is taken out by lawyers to indemnify or cover losses to clients arising from errors or fraud in dealing with their matters. Some firms seek to charge for this as a separate disbursement but it should be covered by the firm’s own costs and it is not a proper disbursement.

Indemnity Insurance

This insurance may be suggested by your conveyancer to protect, either you, your mortgage lender or both, to cover a potential liability, a defect in title or missing/lack of building/planning documents. Common issues which may be insured against include a lack of planning permission or building regulations consent for an extension, breach of covenant, or missing title documents.

Initial Payment

This is a small deposit to cover the expenses that the buyer's conveyancer will incur during the early stages of the transaction, to cover the cost of, for example, the searches.

Joint Tenants

A form of ownership of a property, where, upon the death of one of the owners, the property will automatically be transferred to the surviving owner(s). This will happen irrespective of whether or not the deceased has made a Will. Neither of the owners can leave their share of the property to someone else. The sole survivor can deal with the property any way they want. For the alternative option, please see Tenants in Common.

Telephone Bidding

Many buyers prefer to bid via phone, using an auction house representative who is present at the auction to relay bids to the auctioneer on their behalf.

Land Certificate

Where a property is registered, this is the official certificate issued by the Land Registry detailing the ownership and interest in the property where there is no legal charge/mortgage/secured loan.

Land Charges Search

A search at the Land Charges Registry is to show any relevant entries on the register and any financial claims, planning permissions, building control applications and other council decision or restrictions that affect the property or parcel of land.

Land Registry

Her Majesty’s Land Registry is the government department formed to maintain and develop the register of title to freehold and leasehold land and properties in England and Wales; basically a record of who owns what and under what conditions.

Land registry fees

The fee payable to the Land Registry to register any change affecting the property including a change of ownership.

Land Registry office copies

The legally permissible document, which will requested by your conveyancing provider, outlining who owns your property, held by HM Land Registry.

Land Registry Search

A search at the Land Registry to check that no undisclosed charges or interests are registered against the property.

Landlord

See lessor

Law Society

The Law Society is the representative body for solicitors in England and Wales.

Lease

This is the document giving the lessee the rights to possession of a leasehold property for the lease term, at an agreed rent and which set out all rules, rights and obligations between a Landlord and a Tenant.

Leasehold

In contrast to a freehold property, a leasehold property is one where a party buys the right to occupy land or a building for a given length of time, e.g.99 or 999 years. When a lease expires however, ownership of the property reverts back to the freeholder, although lease extensions can often be negotiated. Possession of the property will be subject to the payment of an annual ground rent.

Leaseholder

See Lessee

This is an alternative version of the Property Information Form (SPIF) which is used when dealing with leasehold properties.

Legal Fee

The fee charged by your legal representative for their work, e.g. conveyancing.

Legal Charge

See Mortgage

Legal Pack

The Vendor's Solicitor prepares a Legal Pack containing copies of all the legal papers for potential buyers to review. This should include (where applicable) copies of the Special Conditions of Sale, Title Deeds, Leases, Office Copy Entries, Searches and Replies to Pre-contract Enquiries.

Legal Transfer

This is the document which transfers the legal title to the property from one person to another and is signed shortly before completion.

Lender

See Mortgagee

Lessee

Where a property is leasehold the lessee means the current owner of the leasehold property as opposed to the lessor, freeholder or landlord whose interest is subject to the lessees right of occupation until the lease term has come to an end.

Lessor

This is the landlord or freeholder who owns the freehold title and is entitled to the ground rent under the lease and possession of the property at the end of the lease term.

Limited Title Guarantee

Just as Full Title Guarantee confirms the seller’s legal right to dispose of the property, due to the seller's limited knowledge of the property, the Full Title Guarantee cannot be given, for example a personal representative of a deceased owner or a mortgagee in possession. The purchaser must therefore accept some risk, as there is no guarantee that the property is not subject to overriding interests, covenants or charges.

Local Authority Search

This is a set of questions about the property, which are sent to the local authority, for example, whether the road serving the property is maintained by the council and whether there have been any planning applications on the property. The search is against the property only and does not cover the surrounding area.

Lot

Each separate land or property being sold described in the catalogue

Major Works

This is a term used by Landlords for work carried out to a flat or maisonette block of a periodic or extraordinary nature, the cost of which isn’t covered by the monthly service charges. The Landlord has to let the lessee know about this in advance, and there are detailed consultation processes which have to be complied with before any invoices can be raised.

Mining Search

A search to check whether the property may be affected by coal mining activity which could result in subsidence.

Mortgage

A loan to buy property where the mortgagee (lender) lends the mortgagor (borrower) money in return for a legal charge being registered against the property to ensure that the loan must be repaid before the property can be sold.

Mortgage fees

These fees are sometimes charged by solicitors for acting on behalf of your bank or building society.

Mortgage Offer

This is the formal offer of advance from your Mortgage Lender, and will set out the mortgage product, terms and conditions attached to the loan as well as the amount of money being provided and all interest and fees. The Offer will be in a standard form as prescribed by the Financial Services Authority.

Mortgage Deed

This is a legally binding document signed by the mortgagor to create a legal charge which the mortgagee can register at the Land Registry. It also shows that the mortgagor consent to the mortgagee’s loan being secured on the title to the property (which means that they can repossess the property should the mortgage payments fall into arrears).

Mortgage Offer

The details of the terms upon which the mortgagee is prepared to make the mortgage loan.

Mortgage Term

The length of time agreed for the repayment of the loan.

Mortgaged

Where a property has been charged by the owner or mortgagor to the mortgagee.

Mortgagee

A lender who provides a mortgage (e.g. a bank or building society)

Mortgagor

A borrower who takes out a mortgage.

Negative Equity

A situation where the amount of money you owe on the mortgage on the property, usually via a mortgage, is more than the sale value of the property.

No Title Guarantee

With No Title Guarantee, because of the seller's limited knowledge of the property, for example when receivers or mortgagees sell a property following repossession, the Full Title Guarantee cannot be given, The purchaser must therefore accept some risk as there is no guarantee that the property is not subject to overriding interests, covenants or charges.

Occupier

This is an adult who resides at a property other than the registered owner(s).

Occupier’s Consent

If the property is being sold, the Occupier will be required to sign the contract or a waiver confirming that they will be vacating the property on or before completion and waiving any rights of occupation which may have arisen. On a property purchase, the Mortgage Lender will provide a similar form in which any Occupier will waive their rights of occupation in the event that the lender has to take possession

Office Copies

These are official copies of the Land Registers sent to the buyer’s solicitors to prove the seller’s title to the property.

Old arrears

Arrears due under any of the tenancies that are not “new tenancies” as defined by the Landlord and Tenant (Covenants) Act 1995.

Particulars

The section of the catalogue that contains descriptions of each lot (as varied by any addendum).

Party Wall

A wall owned jointly with a neighbour and repairable at shared expense.

Planning Permission

This is the formal consent of the Local Authority planning department to build, extend or alter a building. This includes change of use.

Practitioner

An insolvency practitioner for the purposes of the Insolvency Act 1986 (or, in relation to jurisdictions outside the United Kingdom, any similar official).

Pre-completion searches

These are searches undertaken by your conveyancing provider before contracts are exchanged. They check to see whether you have been or have become bankrupt and that the property in question is legally owned by the seller. Also known as priority searches.

Priority searches

See pre-completion searches.

Price

The price that the buyer agrees to pay for the ot.

Private Road

A road maintained by property owners rather than by the local authority. The property owners need to have rights over it as it is not necessarily a public access.

This is a questionnaire about the property completed by the sellers. It covers such items as guarantees, neighbour disputes and boundaries. If you are buying then time can be saved if you tell your solicitor at an early stage if there are any particular points about the property that concern you.

Purchaser

The person(s) buying a property.

Ready to complete

Ready, willing and able to complete: if completion would enable the seller to discharge all financial charges secured on the lot that have to be discharged by completion, then those outstanding financial charges do not prevent the seller from being ready to complete.

Redemption

The repayment of an existing mortgage.

Redemption fee

A penalty sometimes incurred if paying off a mortgage early.

Redemption Statement

This is a statement from a mortgage lender detailing exactly how much money is needed to repay the mortgage. This may include any early repayment charge or penalty and any additional fees payable to the mortgage lender.

Registered Land

Property which has already been registered at the Land Registry.

Rentcharge

Some freehold properties are subject to a rentcharge payable to the rentcharge owner. This may be to ensure that estate covenants can be enforced more easily or to provide income for the original land owner without the existence of a lease.

Reparations

The compensation or remuneration required in the event of a breach of contract.

Reservation fee

An administration fee charged to cover the cost of reserving a mortgagor’s entitlement to a loan on certain terms, or a fee paid to a builder or property developer to reserve a new property.

Reserve or Reserve Price

Never formally disclosed, the reserve price is the confidential minimum price agreed upon between the seller and the auctioneer.

Results

Immediately following every auction, results are posted online. Customarily, results include the hammer price plus the buyer’s premium.

Retention

This is a sum of money held back by a party in a transaction. A purchaser’s conveyancer will often request that a sellers conveyancer hold back a sum of money after completion of a leasehold transaction in case a deficit is revealed when the end of year service charge accounts are issued. Alternatively, a Mortgage Lender may decide to make a retention on the loan until crucial works are completed at the property.

Sale

The sale of a property.

Sale conditions

The general conditions as varied by any special conditions or addendum.

Sale memorandum

The form so headed (whether or not set out in the catalogue) in which the terms of the contract for the sale of the lot are recorded.

Searches

Searches are conducted to gain an understanding of external matters which might affect a property. The most common searches obtained on a purchase are a local authority search (which details planning applications, listed building applications etc) and a water and drainage search (to confirm that you are connected to the water mains and sewerage system). There will also be an environmental report, which will detail the likelihood of the property lying on contaminated land and any flooding or subsidence risks. If your property is an area once used for coal mining, tin mining or brine extraction there may be the need to carry out additional searches.

Seller

The person selling the land or property. If two or more are jointly the seller their obligations can be enforced against them jointly or against each of them separately.

Service Charge

A payment required by a lessor or managing agent to cover the costs of maintaining, running and insuring a development.

Smoke Control Order

An order made by the local authority designating an area to be one in which only smokeless fuels may be burnt (i.e. not coal or wood).

Solicitor

The legal conveyancing process can be undertaken by a trained property solicitor. See conveyancer.

Solicitor’s Regulation Authority (SRA)

The independent regulating body of the Law Society of England and Wales, the SRA can be called upon to deal with disputes if you have received an unsatisfactory service from a solicitor.

Special conditions

Those of the sale conditions so headed that specifically relate to the lot.

Special Mortgage Conditions

The special conditions are detailed within your mortgage offer and must be read through carefully, as failure to comply with these conditions would be a breach of the mortgage terms, and would be treated in much the same way as failing to keep up your monthly payments.

Stamp Duty

Stamp Duty Land Tax (SDLT) is paid to the government on the purchase of a property, based on the purchase price, over a certain value. See HMRC Website.

Standard Conditions of Sale

A form of general conditions created by the Law Society which form the basis on which conveyancing transactions are governed.

Subsidence

Where a property moves due to inadequate foundations or a significant change to the underlying ground, which results in instability in the structure of a building.

Survey

This is a report carried out on the physical state of a property. When buying a property it is important to be aware that the property is "sold as seen" and it is therefore for the buyer to discover any physical defects by means of inspections and surveys. Most houses, bought with the assistance of a mortgage and the bank or building society, will require a mortgage valuation. However, this is not a survey - it merely ensures that the property is of sufficient value to protect the lender's interest.

Telegraphic Transfer

This is the process by which money is moved electronically from one bank account to another.

Tenancies

Tenancies, leases, licences to occupy and agreements for lease and any documents varying or supplemental to them.

Tenancy schedule

The tenancy schedule (if any) forming part of the special conditions.

Tenant

See Lessee

Tenants in Common

A form of co-ownership where, on the death of the co-owner(s), the remaining owner(s) is (are) not automatically entitled to the deceased’s share in the property. The deceased’s share will pass in accordance with their wishes contained within their Last Will and Testament.

Term Assurance

Life insurance which only last for the term of the mortgage.

Third party rights

When someone other than the legal owner of a property has the right to use or control the land over which they have no ownership.

Tin Search

A search to establish whether the property may be affected by tin mining activity which may result in subsidence.

Title

This is the right of ownership of a property.

Title Deeds

These documents firstly act as evidence that the person selling the property actually owns it, and secondly they set out any rights or obligations that affect the property.

This is an official copy of the title to the property, as held by the Land Registry. It is simply a few pages of A4 paper that shows the address of the property, name of the property owner (and details any mortgage lender having an interest in the property). The Title Information Document replaces traditional Title Deeds.

Transaction

A dealing with property (e.g. sale or purchase)

Transfer

Transfer includes a conveyance or assignment (and “to transfer” includes “to convey” or “to assign”).

Transfer deed

This is the document that passes the ownership of the property from the vendor to the buyer. It is dated with the completion date, and will be sent to the Land Registry after completion.

Transfer of equity

A document transferring ownership of a share or interest in a particular property from one person to another.

Tree Preservation Order

An order made by the local authority protecting a tree or group of trees, the local authority’s permission must be gained before lopping or felling them.

Unregistered Title

Where the title to a property has not previously been registered at the Land Registry.

Vacant Possession

Possession of a property free of the presence of any people, possession or rubbish.

Valuation

A very basic form of survey simply designed to establish the market value of the property.

VAT

Value Added Tax.

VAT option

An option to tax.

Vendor

See seller

Water Drainage Search

This confirms whether the property is connected to a public or private water supply, how the property is billed for the water and wastewater (either rateable value or water meter), whether the property is connected to a public sewer or septic tank or other private disposal facilities and confirmation whether the property is close to or is affected by water mains or public sewers.

Wayleave Agreement

A formal agreement with a property owner enabling a service provider (electricity or telephone company) pass their piping or cabling through or over the property.

Vacant Possession

A property, when vacated, has to be completely empty of possessions (apart from fixtures and fittings that you have agreed to leave intact) and rubbish etc – including any loft, shed and garage.