Understanding Auctions

Introducing Auctions

With a normal open market transaction, neither the buyer nor seller is committed to the sale until written contracts are exchanged. So there is a period following the acceptance of the buyer’s offer when investigations will be made as to the seller’s title and making various searches and enquiries about the property. Only when all this has been done, and the buyers are willing and able (in funds) to purchase, will contracts be exchanged and both parties committed to completing the deal.

With an auction however, following the fall of the gavel, the successful bidder is committed to complete the purchase whether or not they have made any enquiries about the property. So any due diligence both physical and legal will have to be done prior the sale itself and as a buyer, you need to have your ducks lined up.

Speed is of the essence

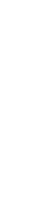

The fall of the auctioneer’s hammer signifies the legal acceptance of the offer to purchase the property. If it is you who has made the last bid, this therefore means that you have entered into a legally binding agreement that carries the same legal implications as formal exchange of signed contracts within a normal open market sale and purchase transaction.

You are legally required to complete the sale, usually within 20 working days of the date of the auction (although sometimes the completion date differs, and this will be set out in the Special Conditions).

Equally, for anyone wishing to sell their house quickly, the speed and legally binding nature of an auction transaction also makes the process appealing. Whereas a standard property sale can often take months, with some deals falling through at the last minute, an auction allows for a swift and decisive transaction. However again it is critical to note that, once the hammer falls, the property is sold for the final bid price, there is no pulling out or opportunity for further negotiation.

Have funding in place

Once the bid is accepted, you will be immediately required to pay a deposit, which is usually 10% of the total price that has been agreed. Therefore, if for example you have bid £150,000 for the property and yours is the final bid accepted, you must hand over £15,000 on the auction day.

This is usually non-returnable and acts as security for the seller in case you either cannot or do not want to complete. If that happens, the seller may be able to keep your deposit, and may take you to court to recover any additional losses arising from the breach of contract.

In order to complete, in the 20 working days or less, the remaining 90% (in this example, £135,000), plus costs, of cleared funds must be in your solicitor’s bank account prior to actual completion date. If you are taking out a mortgage, your solicitor will draw down the loan amount from the lender in time for completion.

Stay professional

The quick turnaround provided an auction sale or purchase can be a real attraction; however, it should not lead to a suspension of either common sense or sound business practice. When undertaking any significant transaction, good research is essential and, despite the emotional atmosphere an auction presents, a buyer must remain logical while taking a professional approach throughout.

Be practical, stay calm and good luck.